new mexico solar tax credit 2019

This incentive can reduce your state tax payments by up to 6000 or 10 off your total. New Solar Market Development Income Tax Credit Until 2029 non-dependent tax payers who purchase and install a thermal or photovoltaic system in their home business or.

A Major Player In Solar Energy Leaves Some Customers Seething Salon Com

25D g provides a credit of 30 if the property was placed in service in a residence before Jan.

. Schedule PIT-CR is used to claim non-refundable credits. Enacted in 2002 the new mexico renewable energy production tax credit provides a tax credit against personal or corporate income tax. Waiting to the end of the calendar year or until tax filing season may cause the loss of this tax credit due to annual funding limits.

New Mexico Solar Tax Credit 2019. Non-refundable credits can be used to reduce tax liability but if the tax due is reduced to 0 the balance of these credits is not. 1 2020 a 26 credit if the property was placed in service after Dec.

Solar Incentives Tax Credits and Rebates in New Mexico. That will decrease to 26 for systems installed in 2033 and to 22 for systems installed. Those who install a PV system between 2022 and 2032 will receive a 30 tax credit.

Systems installed on or before December 31 2019 were also eligible for a 30 tax credit It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034. 375 enacted in April 2009 created a tax credit in New Mexico for geothermal heat pumps purchased and installed between January 1 2010 and December 31 2020 on property owned. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit.

11 rows See all our Solar Incentives by State All of New Mexico can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment. The 26 federal tax credit is available for purchased home solar systems installed by December 31 2022. New mexico solar tax credit 2019.

The current tax credit allocation is 12 million. Questions answered every 9 seconds. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems.

The 10 state solar tax.

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Solar Panels New Mexico Solar Company New Mexico

New Mexico Nonprofit Groups Opensecrets

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

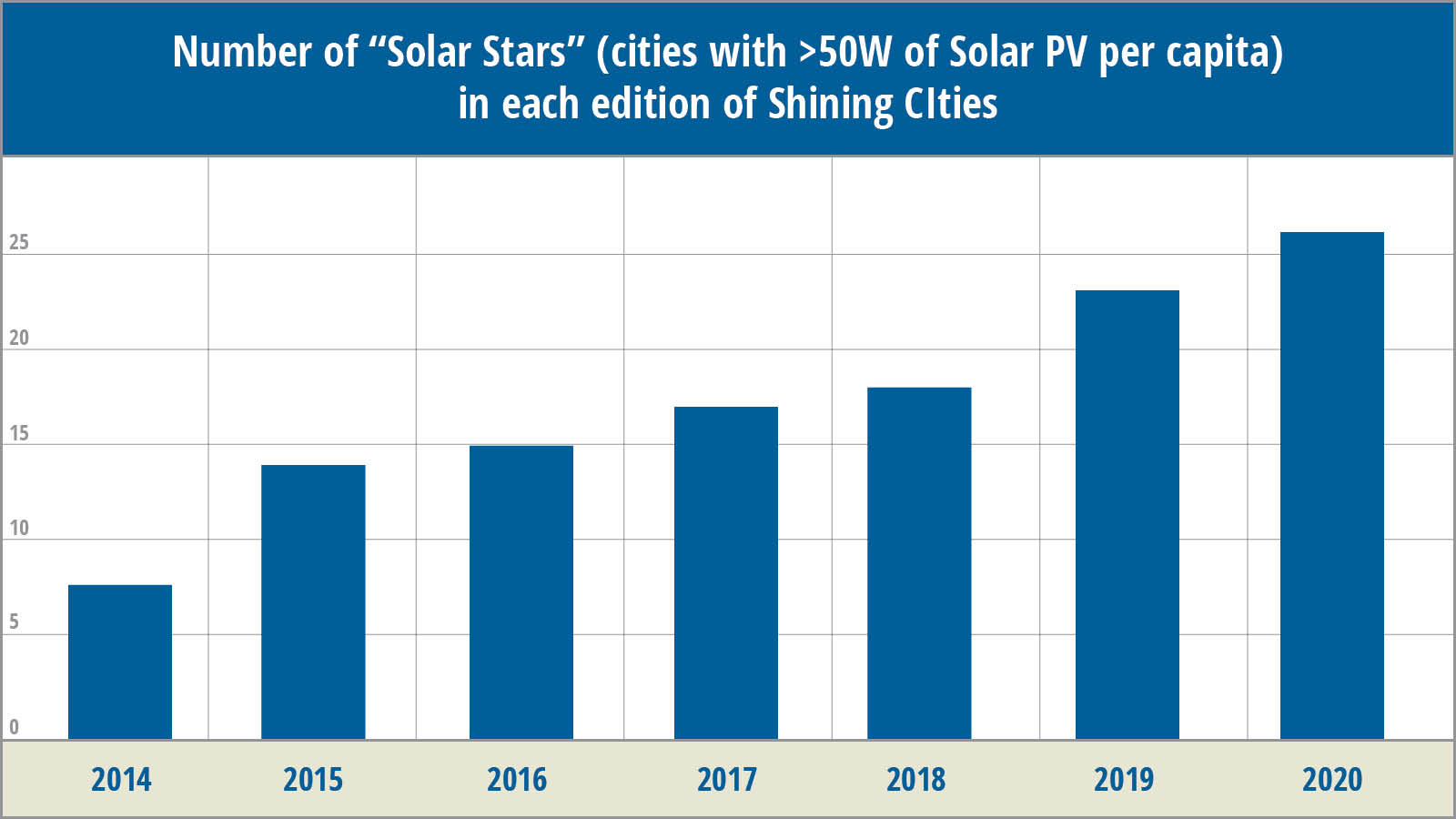

Shining Cities 2020 Environment America Research Policy Center

U S Energy Information Administration Eia Independent Statistics And Analysis

Federal Solar Tax Credit 2022 How Does It Work Adt Solar

What You Need To Know About New Mexico Solar Tax Credits

Center For Resource Solutions Crs Through Its Green E Certification Programs Certified Nearly 69 Million Megawatt Hours In Retail Transactions In 2019 Representing An Overall Increase Of 11 Compared To 2018 Sales This Is The Highest Number Of

Solar Tax Credit In New Mexico Could Be Reinstated New Mexico Solar Incentives

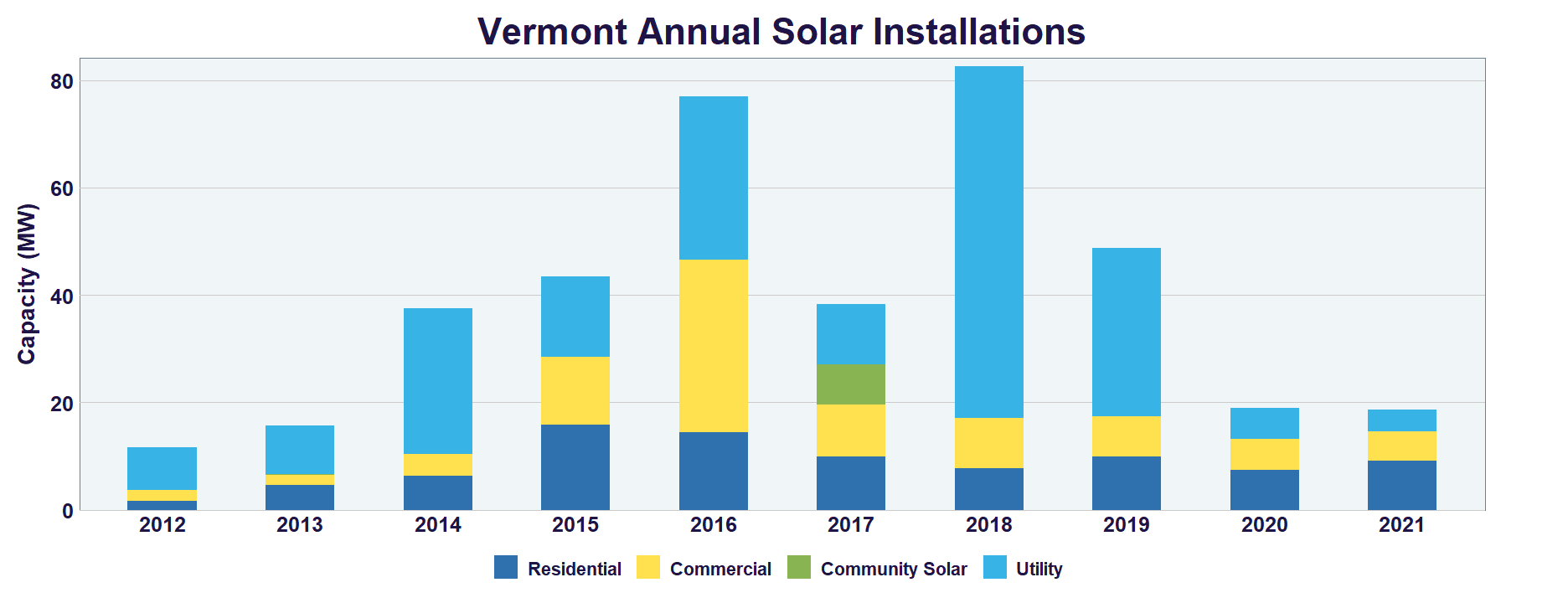

50 States Of Solar Incentives Vermont Pv Magazine Usa

Solar Power Tax Credit Transferability Is On The Table Pv Magazine Usa

Understanding Solar Financing Noble Solar

Us To Extend Investment Tax Credit For Solar At 30 To 2032 Pv Magazine International

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Is Getting Solar Panels On Your Roof Worth The Money

Georgia Solar Incentive Tax Credit And Rebate Guide 2022

What Is Holding Back Renewable Energy Development In Indian Country Clean Energy Finance Forum

Solar Power Could Be The New King As Global Electricity Demand Grows Cnn Business